Concept of Debit and Credit

Therefore it is vital to balance each transaction in double-entry accounting to have a clear and accurate general ledger financial statement and look into the. Debits and credits is a classification method that is used for coding the financial transactions of a business and recording them in the bookkeeping system.

What Is Debit And Credit An Easy To Understand Explanation

Rules of Debit and Credit Class 11 Chapter 6Journal Entry Concept Modern Approach Traditional ApproachRules of Debit and Credit HindiConcept of Debit and Cre.

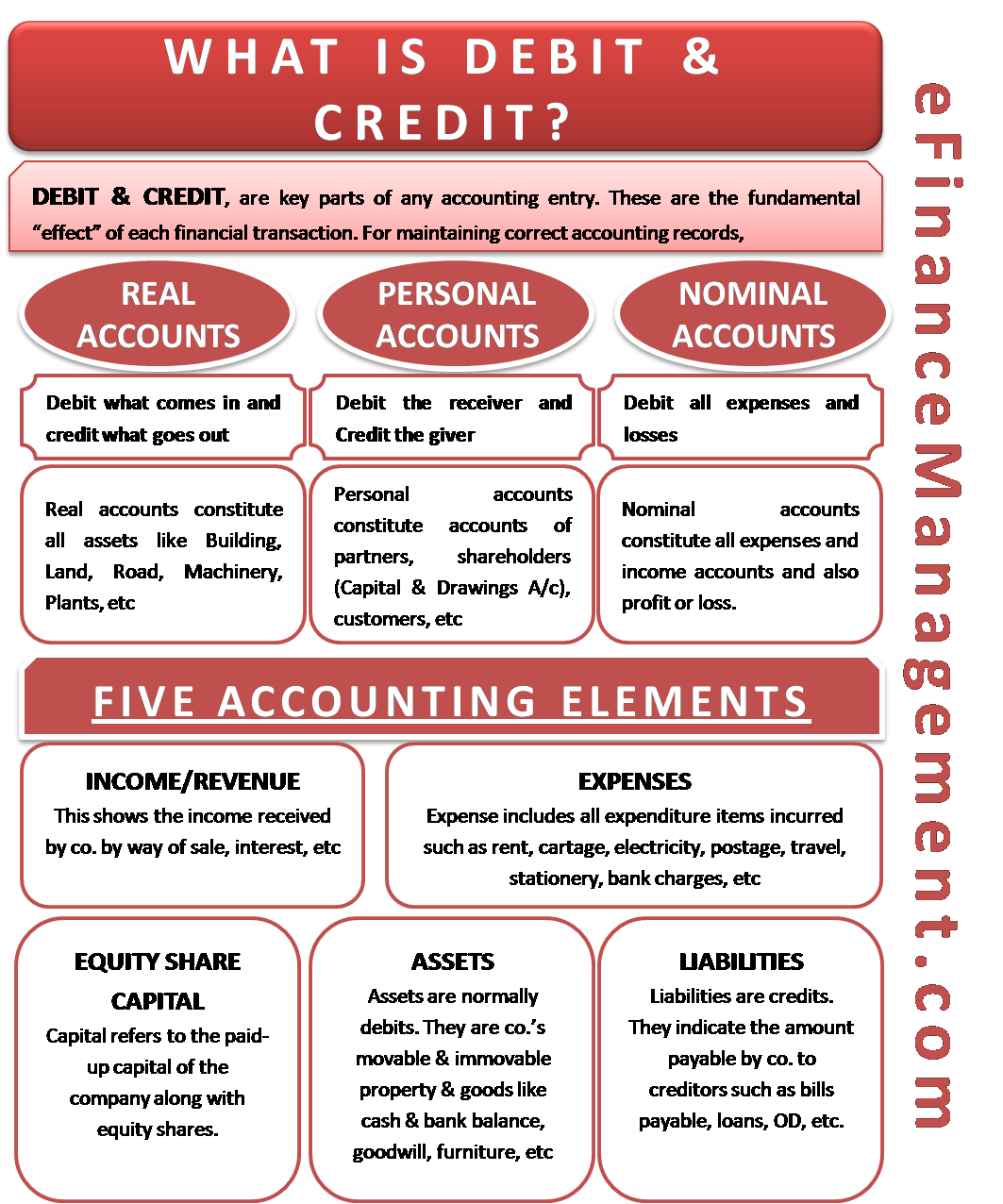

. A debit entry increases an asset or expense account or decreases a liability or owners equity. Debits and credits are terms used in accounting and bookkeeping systems for the past five centuries. The Chart of Accounts established by the business helps the business owner determine what is a debit and what is a credit.

Debits abbreviated as Dr are one side of a financial transaction that is recorded on the left-hand side of the accounting journal. A credit the exact opposite. Application of the rules of debit and credit.

It is an accounting entry that is recorded to show an increase in liabilities or equity. There can be considerable confusion about the inherent meaning of a debit or a credit. Debit is derived from the latin word debitum which means what we will receive.

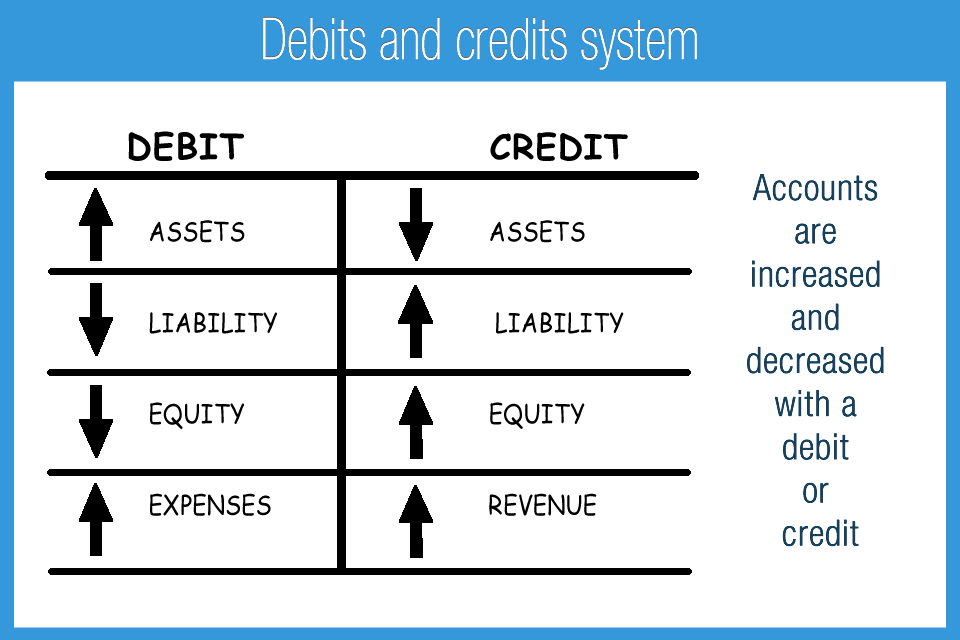

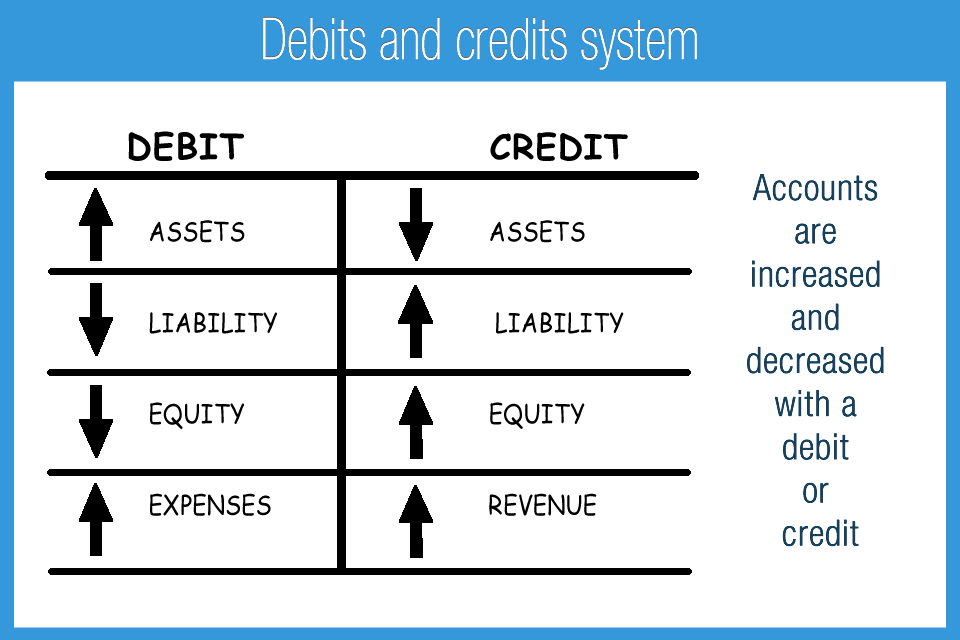

An increase is recorded on the debit side and a decrease is recorded on the credit side of all asset accounts. This double-entry system provides accuracy in the accounting. Debits are always on the left side of the journal entry and credits on the right.

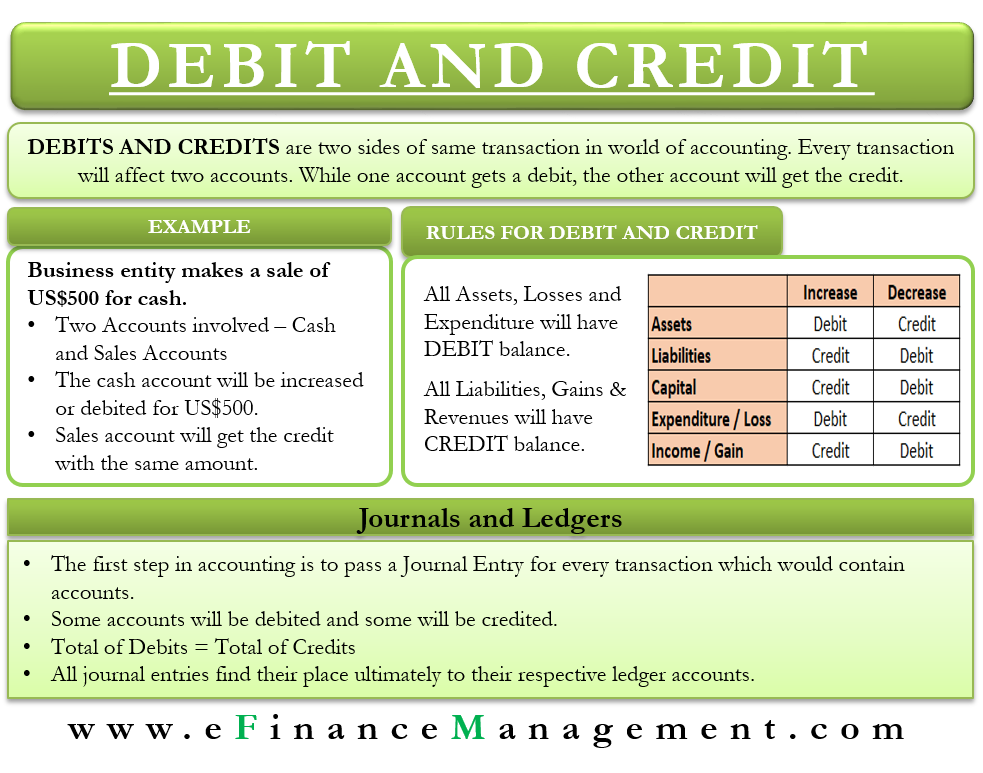

Definition of Debits and Credits. For example if you debit a cash account then this means that the amount of cash on hand increasesHowever if you debit an accounts payable account this means that the amount of accounts payable liability decreasesThese differences arise because debits and credits have. For example a company has made a loan to the Bank of 30000 as initial capital.

Every transaction has two effects. Happiness for an accountant is when debits equal credits. But debits and credits do not seem to be intuitive concepts for many analysts so let us think of them in the context of something everyone understands.

Proper memorization and application of the basic concepts is invaluable when moving to more difficult concepts. In order to understand debit and credit entries it. Debits and credits also have differences in debt and equity accounts.

The difference between debit and credit is also brought to the fore that assets are essentially those aspects that include cash plant and machinery inventories etc paid for by the company which means an increase in liabilities and reduction in liabilities equity of the said entity. Debits are recorded in the left column of a journal or general ledger. They are part of the double entry system which results in every business transaction affecting at least two accounts.

More concepts related to debit credit. Debits and Credits reflects the flow of economic resources that takes place in a financial transaction as the economic resources transfer from a source Credit to a destination Debit. Rephrasing the original statement in double entry accounting the balance sheet is always kept in balance by making the uses of cash equal the sources of cash.

The most important concept to understand when dealing with debit and credit is that the total amount of debits must be equal to the total amount of credit in every transaction. So for every debit there is a corresponding credit of an equal amount. So in the journal you can know the cash.

Solid understanding of debits and credits is necessary for a student CPA exam taker and accounting professional. Debit Credit are shortly mentioned as Dr. The basic rules of debit and credit applicable to various classifications of accounts are listed below.

Before understanding the explanation and use of debit and credit we will briefly introduce their use and how the concept of double-entry emerged. There must be a minimum of one debit and one credit for each. The amount in every transaction must be entered in one account as a debit left side of the account and in another account as a credit right side of the account.

Credits abbreviated as Cr are the other side of a financial transaction and they are recorded on the right-hand side of the accounting journal. A basic understanding is that an entry to the left side column is Debit and an entry to the right side column is Credit. A credit also reflects a decrease in assets revenue or expenses.

If theyre not equal youve probably made a mistake. A credit does the opposite. It is the destination who enjoys the benefit.

At least one of the accounts will receive a debit entry and at least one other account will. In double entry book-keeping debits and credits abbreviated Dr and Cr respectively are entries made in account ledgers to record changes in value due to business transactions. Debits and credits are terms used by bookkeepers and accountants when recording transactions in the accounting records.

Debits Vs Credits A Simple Visual Guide Bench Accounting

Debit Vs Credit Accounting The Ultimate Guide Article

Debits And Credits Accounting Play

Debits And Credits Introduction Journal And Ledger Usage

0 Response to "Concept of Debit and Credit"

Post a Comment